2020 Tax Relief

October 15 is the filing deadline for those who requested an extension Taxpayers who requested an automatic filing extension should complete their 2019 tax returns and file on or before the Oct. Small business stimulus relief options such as the Paycheck Protection Program PPP and Economic Injury Disaster Loans EIDL have become household names during the COVID-19 pandemic.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Latest Tax Relief Calculate And See How Much Income Tax You Need To Pay In 2020 News Cloud

Late-filing penalties still apply File your tax return early or before the due date to avoid being charged a late-filing penalty and disruption of your benefit and credit payments such as the Canada Child Benefit CCB and the GSTHST credit.

2020 tax relief. The tax credit in the UK is the lower of the. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. Four relief measures have been announced by the Victorian Government.

Tax rebate for Spouse husband or wife. Between 2013 and 2017 individuals under 65 years old could claim an itemized deduction for unreimbursed medical. Subject to what follows you can get relief at the rate of 30 on the aggregate of the amounts claimed for shares issued to you in tax year 2019 to 2020 after taking account of any claims to.

A fundamental aspect of tax relief services is their ability to favorably resolve debt situations. The filing deadline for the 2020 tax year is April 15 2021. DISASTER TAX RELIEF ACT OF 2020 Section by Section TITLE I EXTENSION OF CERTAIN PROVISIONS Subtitle A - Certain Provisions Made Permanent Sec.

Interest relief only applies to your 2020 taxes owing and not on previous or other debts with the CRA. Text for HR3301 - 116th Congress 2019-2020. Coronavirus Aid Relief and Economic Security CARES Act PL.

Taxpayer Certainty and Disaster Tax Relief Act of 2019. Small business tax relief and your 2020 taxes. For the 2019 and 2020 tax years the traditional IRA contribution limit is 6000 per person with an additional 1000 catch-up contribution allowed for individuals who are 50 years old or older.

Penjana Special Tax Relief Pelepasan Cukai Istimewa Penjana of RM2500 for the purchase of a personal computer smartphone or tablet effective 1 June 2020. Heres LHDNs full list of tax reliefs for YA 2020. You will be granted a rebate of RM400.

The 2021 land tax relief measures are. Wildfire and straight-line wind tax relief In addition to the tax relief offered as a result of the COVID-19 pandemic the department also provides relief for those Oregonians who have been affected by the wildfires and straight-line winds in the summer of 2020. The differences between YA 2019 vs YA 2020.

Or October 15 2021 if you apply for an automatic filing but not paying extension Which means you account for your 2020 tax bill in 2021. The first deferment can be claimed in your April 2020 EMP201 return which is due by 7 May 2020. This is a new tax relief introduced as part of the response to the Covid-19 pandemic.

Self Parents Spouse 1. Upcoming Tax Brackets Tax Rates for 2020-2021. Most federal tax deadlines from April 1 2020 to July 14 2020 are extended to July 15 2020 for coronavirus tax relief.

Exempting additional payments under the JobKeeper program from payroll tax - announced on 5 May 2020. Land tax reduction and deferral 28 July 2021 to 15 January 2022 for landlords of commercial tenancies including properties that have single and multiple commercial tenancies and commercial owner-occupiers. Find the latest updates and forms affected.

The payments must be made between 1 March 2020 and 31 December 2020 to qualify for tax relief in YA 2020. The IRS noted however that because tax payments related to these 2019 returns were due on July 15 2020 those payments are not eligible for this relief. We evaluated each tax relief services customer service responsiveness unresolved legal disputes and review-based reputation.

Relief by way of credit for foreign tax paid. Waiving of 2019-20 payroll tax for employers with annual Victorian taxable wages up to 3 million - announced on 21 March 2020. Tax rebate for Self.

116-136 was signed into law on March 27 2020. There are a variety of options for dealing with IRS back taxes each of which have their own pros and cons which will need to be considered when deciding on your tax resolution strategy. CoviD-19 Tax Relief Measures YourTaxMatters To claim CoviD-19.

Related Tax Relief Act of 2020 would reduce federal revenue by 1673 billion from FY2021 through FY2030 Table 24 The Taxpayer Certainty and Disaster Tax Relief Act of 2020 enacted as Division EE of PL. Reduction in medical expense deduction floor. Taxpayers could receive up to 1200 per adult 2400 for a married couple and an additional 500 for each dependent child but the payments were phased out for taxpayers with higher incomes.

All the services we recommend include free consultation and at the very least a 15-day money-back guarantee. Does the relief apply to the penalty for failing to pay estimated tax payments timely during 2019. Deferring 2020-21 payroll tax liabilities for employers with Victorian payrolls up to 10.

There are new incentives introduced for income tax relief 2020 compared to tax relief 2019 such as. Do note that everything youre claiming for below must be supported by proof of documentation or receipt in the event of a tax audit. Claiming these incentives can help you lower your tax rate and pay less in overall taxes.

A tax rebate reduces your amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2020. Medical treatment special needs and carer expenses for parents. Moreover the accommodation premises must be registered with the Commissioner of Tourism to be eligible for the relief.

This can get a bit confusing. Updated as of 3102021. 2020s Best IRS Tax Relief Programs.

Tax relief for individuals and businesses in the CARES Act includes a one-time rebate to taxpayers. Granted automatically to an individual for themselves and their dependents. Any statute of limitations relating to claiming prior year income tax refunds or credits that would have expired from April 15 2020 and before July 15 2020 is now extended to July 15 2020.

Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019. 31 deadline applies to the third quarter estimated tax payment due on September 15. Individual and dependent relatives.

2021 land tax relief. 2020 Stimulus and Tax Relief In April 2020 the IRS started sending out Economic Impact Payments commonly referred to as stimulus payments or recovery rebates. Modification of the tax treatment of certain retirement fund withdrawals and charitable contributions.

116-260 contains numerous additional tax provisions. PAYE tax relief period The Covid-19 Tax Relief for PAYE is available for the four-month tax period from 1 April 2020 to 31 July 2020. For both income and capital gains the same principles apply when claiming Foreign Tax Credit Relief FTCR.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Quick Guide Singapore Budget 2020 Personal Tax Relief Measures Paul Wan Co

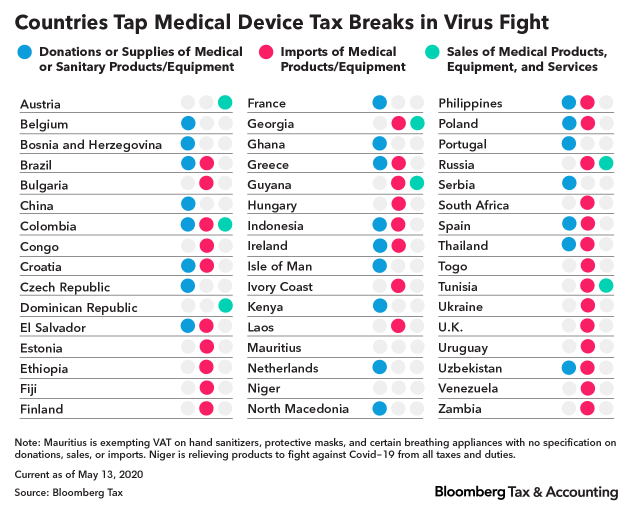

A Global Push For Pandemic Tax Relief On Medical Equipment

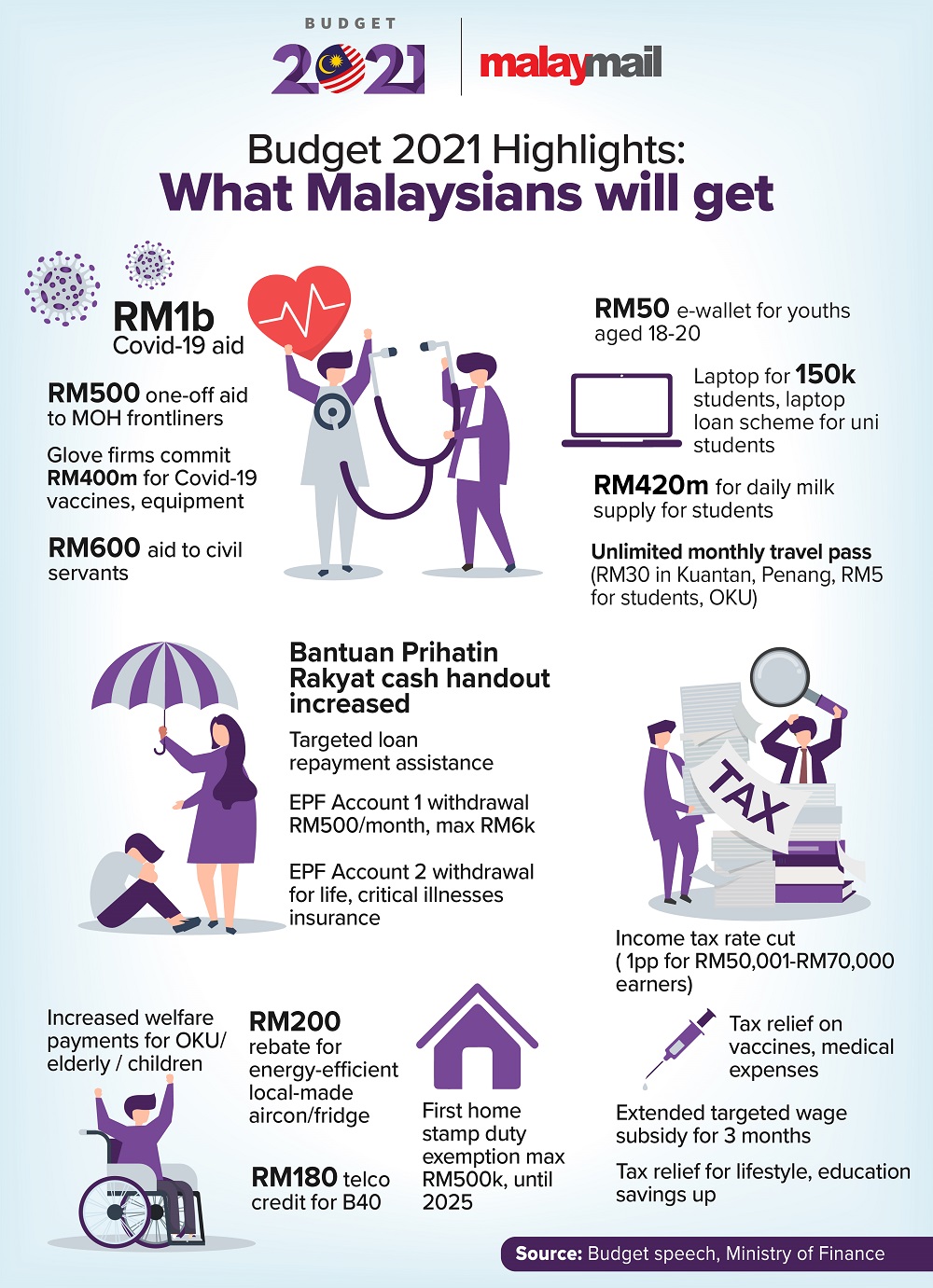

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Singapore Personal Income Tax Guide How To File And Pay Your Personal Income Tax Ya 2021

Iras On Twitter Filing Your Taxes Refer To This Nifty Guide To Check Out The Reliefs And Deductions Available For Tax Savings Next Step Claim All The Tax Reliefs That You Re Eligible

Malaysia Personal Tax Relief Ya 2019 Cheng Co

Komentar

Posting Komentar